Company Deep Dive: Taiwan Semiconductor Manufacturing Co Ltd

- Raihan Noor

- Sep 15

- 7 min read

Executive Summary

Taiwan Semiconductor Manufacturing Co Ltd (Ticker NYSE: TSM // TWSE: 2330) stands at the top as a global leader in the semiconductor industry. Specialising in manufacturing semiconductor chips, it's the world's most advanced "pure-play" foundry.

What makes TSMC so special is its incredible competitive edge, which enables it to churn out billions of advanced process nodes at a low cost to the biggest tech giants such as Nvidia and Apple. The company experienced rapid growth recently, with its market share surging to 70% in the Foundry Sector. TSMC is poised for continued growth as it plays a key role in today's market, particularly in AI, high-performance computing, and the increasing silicon content in devices such as smartphones and cars. Financially, TSM delivered exceptional results with revenues growing 30%+ YoY, gross margins at a healthy 42.7% and Net Income surpassing $12 billion in Q2. Recently, the company announced a $165 billion investment in the US, highlighting TSMC's aggressive Capital expenditures to ensure its global footprint.

Most equity research analysts and investment banks rate TSMC as a Buy, citing its AI-driven growth, industry leadership and its undervalued share price compared to its peers. Of course, this investment case is nuanced as TSMC faces many risks, including geopolitical tensions, challenging macroeconomic environments, and operational concerns.

Company Overview

Founded in 1987, TSMC pioneered the "dedicated IC Foundry" business model. Essentially, they manufacture (not design) the most advanced integrated circuits (most notably the 3-nanometer chips) to external clients, including Apple, AMD, Nvidia, and Qualcomm. Its business model is simple: don't compete with customers, focus exclusively on contract manufacturing. As a result, this model is asset-intensive and scale-driven, focusing solely on volume, yield, and R&D.

Core Operations

TSMC currently have over 20 manufacturing sites (or fabs) with most found across Taiwan but also in other places such as Shanghai, Arizona and Washington. Its main products are the advanced logic chips with over 16 million 12-inch wafers produced in 2024. Currently, TSMC employs over 65,00 people with the workforce split approximately 70% technical and 30% operational/support staff.

Advanced logic chips are not the only source of revenue, however. It also provides advanced packaging services. In layman's terms: Once a chip is made, it needs a “home” that lets it talk to memory and other parts extremely fast. TSMC offers advanced wrapping techniques to do just that. Because AI servers and high-end devices need this speed boost, demand has exploded, and TSMC has nearly quadrupled its capacity in two years. TSMC's packaging services contributed to 10% of revenue in 2024.

The other side is the Research and Development section. In Q2 2025, TSMC invested $4.98 billion in next-gen chips such as the 2nm, which offers high performance, increased efficiency and higher transistor density.

Business Segment Breakdown

TSMC revenues are diversified, but most come from advanced logic applications (chips): In Q2, revenue of $30 billion consisted of:

Segment | Revenue Mix (Q2 2025) | Key Clients |

|---|---|---|

High-Performance Computing (incl. AI) | 60% | Nvidia, AMD, Amazon, Google, Microsoft |

Mobile/Smartphones | 27% | Apple, Qualcomm, MediaTek |

IoT | 5% | Diverse device OEMs |

Automotive | 5% | Bosch, Continental, NXP |

Consumer Applications | 3% | Sony, LG, Samsung |

Corporate Milestones And Strategic Developments

Global Expansion

- To mitigate supply chain and geopolitical risk (more on that below), TSMC announced it will invest over $165 billion in the US, Japan and EU markets, which includes plans for six advanced wafer fabs and two advanced packaging fabs in Arizona, plus an R&D lab in Japan.

Aggressive CapEx

- Fueled by AI and high-performance computing demand, TSMC is allocating $38 - $42 billion in capex, with AI Accelerators being the primary source of revenue/capacity driver. To meet increasing demand, the Advanced packaging and CoWoS capacity will be doubled again.

Technological Leadership

- They were the first to ramp up 3nm chips at scale, and now they may be the first to scale 2nm chips with production scheduled for the second half of the year. Prototype 1.4nm chips have also been sampled to select customers, highlighting the massive lead over Samsung & Intel in terms of yield and power efficiency metrics.

- According to the Q4 2024 earnings call, "Almost all the innovators are working with TSMC.” Apple and ARM account for over 80% of advanced node capacity and have deep relationships with Nvidia, AMD, AWS, Google, etc.

Investment Thesis

TSMC's core value propositions rest on the above, and the scale and reliability of TSMC seem limitless; however, the catalysts below show why so many analysts are recommending a Buy for TSMC:

Key Financial and Operational Catalysts (2025-27)

Catalyst | Details | Impact |

|---|---|---|

AI & HPC Demand Boom | The recent explosion of Generative AI/cloud AI fuels the need for semiconductor chips. | 60% of Q2’25 revenue; 30%+ total growth from the previous years. |

Advanced Node Rollout | 3nm leadership, 2nm ramp (H2 2025), A16 chips scheduled for 2026. | Further perpetuates the tech lead, which in turn sustains margin stability. |

Content Per Device Growth | AI is going to be more common in smartphones, PCs, and autos, further fueling demand. | Mitigates unit cycle weakness. |

Secure Global Partnerships | Early tapeouts for next-gen nodes are underway, and customers already have locked-in deals. | Underwrites revenue visibility, further sustaining growth and market dominance. |

Global Presence & “De-risking” | Major US, Japan & EU fabs sites underway. | Mitigates geopolitical tension between China and Taiwan, as well as the impact of tariffs. But it will dilute margins by 2% |

Pricing/Margin Power | Currently, TSMC makes more for less, allowing strategic pricing. | Gross margin: 58% in Q2’25 |

Competitive Positioning

Currently, TSMC holds 70% of the global foundry market, solidifying its dominance. In contrast, Samsung fell below 13% and Intel (despite showing improvements) fell to single digits.

TSMC peers are trailing behind. For Samsung, revenues are downward-trending due to high defect rates at advanced nodes, eroding customer trust. On Intel's side, renewed government support in the US and improved contract wins highlight positive signals. Yet they are still two leading node generations behind TSMC.

Customer loyalty just seems to be increasing. Samsung customer distrust is causing big players such as Qualcomm to migrate to TSMC. TSMC is already the most significant supplier to major tech companies, and the pool will only get bigger.

In this AI race, TSMC consistently comes out on top. No matter who wins in AI chip design, TSMC wins. No matter who wins in AI services, TSMC wins. No matter who wins in AI model building, TSMC wins.

Key Financial Metrics and Valuation

Valuation Multiples vs. Peers

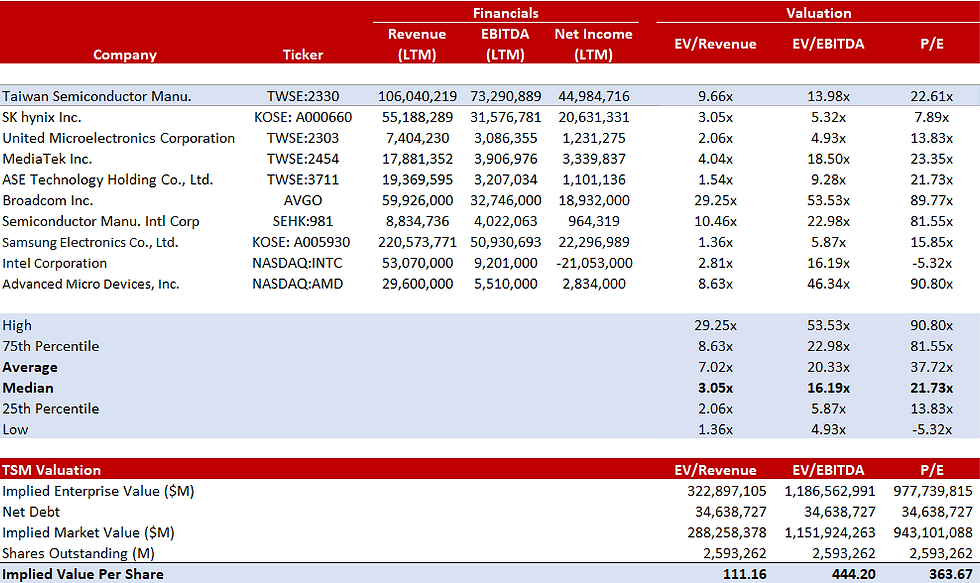

TSMC multiples are at a significant premium to its biggest peers (Samsung and Intel), which is justified by its technological leadership and margin strength.

By using the comp valuation method and using the median P/E score, we can see that TSMC's implied price is $363, compared to the current price of $260; TSMC is trading at a 30% discount.

This makes sense given the broader picture. Let's look at the tech industry as of now. Nvidia's P/E Ratio is trading at 50x, AMD's at 90x and ASML's at almost 40. The market undervalues TSMC due to the Macroeconomic risks associated with China. If Markets see the word Taiwan in the name, they'll be a little sceptical.

Analyst Consensus

A consensus survey of 10 major brokers as of July 2025 finds:

7 “Buy” or “Overweight” Ratings: Citing fundamental growth, capex execution, and technology moat.

2 “Hold” Ratings: Highlighting full/expanded valuation and macro/geopolitical risks.

1 “Underperform”: Citing cyclical risk, China/US supply chain exposure.

The target consensus is around $290, implying a ~12% upside.

As per Morningstar, "TSMC's multiples are currently toward the top end of their 3-year range...backed by wide moat profitability. ...TSMC is undervalued as the market is overestimating tariff effects and underestimating the longevity of AI investments.”

Risks

While TSMC's fundamental risks have been exceptional, investing in TSMC does have its risks.

Geopolitical Risks

- Military Escalation Scenarios: Even perceived risks of military confrontation or blockade can trigger global market volatility and affect TSMC’s valuation multiples. One reason TSMC is trading at a discount is that investors are concerned about the political tensions between China and Taiwan.

- Tariffs: Future tariffs are unpredictable. Morningstar assumes a 10% base case, which can affect revenues by 4%.

- Export Controls: China has some export controls over TSMC, highlighting supply chain disruption, but the company expects a “manageable” impact.

- "Derisking" concerns: Outsourcing fabs to other countries lessens the tension in Taiwan, but this introduces new problems such as substantial capex, higher cost structures, and HR challenges.

ESG & Sustainability Risks

- TSMC expansion requires a lot of resources since manufacturing advanced nodes (like the 2nm) requires a substantial amount of water and energy. More plans to expand will likely lead to more objections from locals, slowing down expansion. However, TSMC's ESG risk is at a "Low" (as per Morningstar), and the firm works with government agencies to ensure the supply of electricity and water is regulated.

CapEx Cycle Risk

- TSMC's forward Capex plans for 2026 show they are planning to spend between $38 - $42 billion in anticipation of the growing AI. Demand. Overbuilding in anticipation of demand could expose TSMC to margin compression in the event of cyclical slowdowns, as witnessed during prior semiconductor downcycles. Should AI demand slow down, we could see TSMC topple regardless of fundamentals.

Conclusion

While these risks are real, management has displayed a record of operational resilience, strategic clarity and readiness for global volatility.

We recommend a Buy of TSMC as of September 2025. TSMC is arguably the most critical single company for the world’s next technology wave. Its foundry leadership, innovation machine, and pivotal role in AI/HPC ecosystems make it the top Buy in global semiconductors for 2025 and beyond. Large-scale investment, customer partnerships, and AI upside are set to outweigh margin dilution and geopolitical uncertainty. The current market does not fully capture the depth or duration of TSMC’s secular growth in AI and advanced process semis, nor its demonstrated resilience through operational or macro shocks.

Disclaimer: This report is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. The analysis and opinions expressed are based on publicly available information believed to be reliable at the time of writing, but may be subject to change without notice. Investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions. The author assumes no liability for any loss arising from reliance on this material.

Comments